Learn how to use the Accountant's Re-create and know more than nearly its limitations in QuickBooks Desktop.

Creating an Accountant'southward Copy is the way to get if you need your accountant to review your books and continue working on your company file at the same time. And with the Accountant's Re-create file transfer feature, the file is saved in Intuit server, where you tin start secured data exchange with your auditor.

| Important: - Ensure Accountant'south Copy and QuickBooks Desktop versions are uniform.

If an accountant makes changes using features that aren't available in the client'due south version of QuickBooks Desktop, changes will not import to the client's file. That's why you need to upgrade your file when you open an Accountant'southward Re-create in newer version of QuickBooks Desktop. Ideally, the client and auditor using the Accountant's Copy feature should utilize the same version or yr of QuickBooks Desktop. But don't worry, you can still work on the Accountant's Copy using a dissimilar version as long as the gap between the versions is just ane year, and the accountant has a more than recent version. For example: - Client: QuickBooks Desktop Pro or Premier 2020

Accountant: QuickBooks Desktop Premier Accountant Edition 2020 - Client: QuickBooks Desktop Pro or Premier 2019

Accountant: QuickBooks Desktop Premier Auditor Edition 2022 or 2020 - Client: QuickBooks Desktop Enterprise 2020

Accountant: QuickBooks Desktop Enterprise Accountant Edition 2020 - Client: QuickBooks Desktop Enterprise 2019

Auditor: QuickBooks Desktop Enterprise Accountant Edition 2022 or 2020 - Gear up the dividing date to define the fiscal menstruum the auditor can work on.

- Accountants can only modify transactions that fall on or before the dividing date.

- While clients can only change transactions in their working file that fall afterwards the dividing date, to prevent conflict or the possibility of overwriting changes.

Annotation: If y'all need to void Auditor's Copy, remove the auditor's copy restriction . |

Accountant's Copy workflow

There are two workflows you tin follow:

- Accountant's Re-create transmission workflow - If auditor uses QuickBooks Accountant Edition just not an active ProAdvisor.

Y'all and your accountant can exchange Accountant'due south Copy file on a USB, attach it on email, or share information technology through cloud service like Box. You lot can transport dorsum the updated version in the same fashion. Check out on how to create an Accountant's Copy for specific details.

- Accountant'south Copy file transfer (ACFT) workflow -If accountant has an agile ProAdvisor membership.

The ACFT feature lets yous and your accountant exchange Accountant'south Copy files through Intuit'southward secure server. Check out on how the accountant's file transfer works to learn more.

Here's how Accountant's Re-create with file transfer feature works:

Stride 1: For Client

- Create Auditor'south Copy to send to accountant .

- You tin can continue to work on current items in the working file (.QBW).

Hither, QuickBooks Desktop saves the Accountant'southward Copy equally an export file (.QBX) to the Intuit server, which triggers the organization to send an email with a download link to the accountant.

Step 2: For Accountant

- Admission and open the file to create working file (.QBA).

- Save your changes and corrections, creating an import file (.QBY), which is saved to the Intuit server.

The client can now open this import file to utilise the accountant's changes to the visitor file.

Accountant's Copy limitations

Here'south what you lot can and can't do in Accountant's Copy.

For Clients

While accountant changes are awaiting

You lot tin can work in the .QBW working file to brand changes to transactions in the current catamenia, afterward the dividing engagement. Here's what you tin can practice:

- Add new entries to any of your lists

- Create, edit, and delete transactions

- Edit the list information

- Plough on Payroll

However, while accountant's changes are pending, you can't make these changes:

- Edit or delete existing accounts

- Send Assisted Payroll Data or Straight Deposits to Intuit

Reconciliation

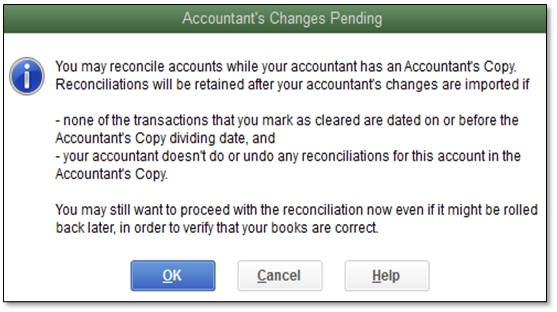

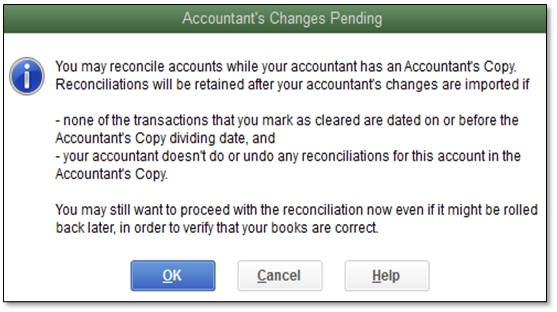

It'southward possible to reconcile your accounts with a pending Accountant's Copy. However, your reconciliation may be rolled back if you clear transactions dated on or before the dividing date, or if your auditor reconciles the Accountant'due south Copy and undoes your reconciliation.Verify with your accountant whether they plan to reconcile the Auditor's Copy before you lot reconcile your accounts in your working file.

Reconciliations performed in an Accountant'due south Re-create are limited to 800 transactions. If the number of transactions reconciled is more than 800, then the reconciliation won't import into the customer file.

For Accountants

Working on Accountant's Copy from customer

QuickBooks Desktop prevents you from editing data or transactions that may conflict with your client'due south work. It also prevents your customer from editing the information before the dividing engagement to avoid conflict with any changes you make.

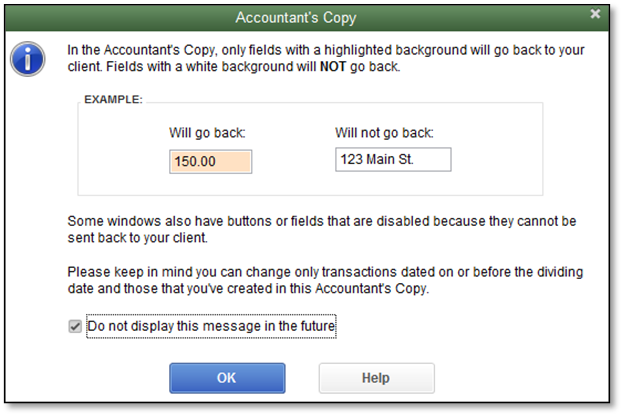

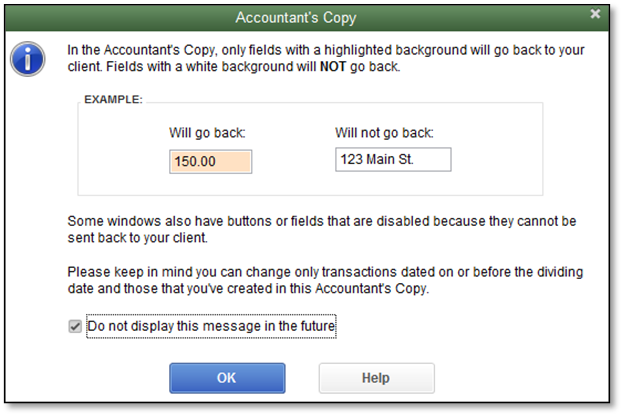

When working in an Auditor's Copy (the .QBA working file), you may encounter disabled or sometimes highlighted areas in a client's file:

- Highlighted groundwork: Information entered in these fields is included in the modify file that you send dorsum to your client

- Non-highlighted background: You can change the information in non-highlighted fields, if necessary, but the changes aren't included in the change file y'all send back to your customer

In that location are likewise some specific limitations of the type of changes you tin brand.

The following sections provide details about the specific changes you tin can and can't make in an Accountant'due south Copy.

Lists

When working with Lists, you can brand the post-obit changes in an Accountant'south Copy:

You lot can't make the following changes:

- Add together, edit, void, or delete build assemblies

- Change the type of an item

- Delete and merge existing accounts

- Enter vehicle mileage

Transactions

When working on transactions, you can make the post-obit changes in an Accountant's Copy:

- Add, edit, and delete most types of transactions dated on or before the dividing date

- Add new transactions dated later on the dividing engagement

- Edit account and revenue enhancement information for existing items (revenue enhancement line mapping tin can't be sent back to the client)

- Temporarily change preferences

- Brand adjusting entries

- Add a new business relationship

Yous tin can't make the following changes:

- Add together, delete, and edit (only not void) payments received

- Add, edit, void, or delete sales tax payments

- Add or use credit carte du jour processing

- Create non-posting transactions such every bit estimates and sales orders

- Edit or void nib payments past credit card

- Transfer funds between accounts

- Add or edit the routing number

Payroll

When working on payroll-related items, y'all are by and large restricted from making changes in the Accountant's Copy. Although you tin can all the same process payroll revenue enhancement forms .

You can't make the following payroll-related changes in an Accountant's Copy:

- Add together, edit, or delete payroll items

- Create, edit, delete, or void paychecks

- Enter, edit, or delete time canvass data

- Create, edit, delete, or void Directly Deposit checks for 1099 vendors

- Send Assisted Payroll Data or Straight Deposits to Intuit

What else you tin can (and can't) exercise

When working in an Accountant's Copy, you lot can brand the following changes:

- Impress 1099 and 1096 forms in the historical menstruation

- Create, adapt, and print 941, 940, and W-two forms

(Y'all can't send adjustments back to the customer) - Create new reports

- Add new customers, vendors, employees, and items

(Exceptions are identified as disabled fields in the Accountant'due south Copy) - Add accounts

You can't make the post-obit changes in an Accountant's Copy:

- Import information from Excel, Spider web Connect, and QuickBooks timer files

- Manage service keys (buy boosted licenses)

- Use planning and budgeting tools

- Use online banking services

- Add routing number

Additionally, you lot tin can't send the post-obit changes dorsum to the client:

- User or countersign changes

- Changes to memorized reports

- Changes to preferences

The Essential Accountant's Copy Guide

This article is part of a series almost Auditor'south Re-create in QuickBooks. To learn more nearly this characteristic, check the following articles:

- Create an accountant'southward copy to ship to your accountant

- Convert the accountant's copy to an accountant'south working file

- Consign accountant's changes

- Import accountant'south changes

- Remove the accountant's re-create restriction

- Catechumen an accountant'south re-create or an auditor's working file to a regular company file

0 Response to "What Can I Change in a qpo File to Be Able to Us It Again in Quickbooks"

Post a Comment